Answer 1.

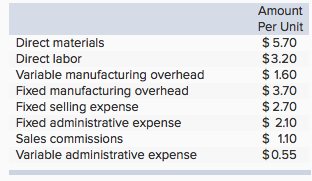

Total Cost per unit = Direct Materials per unit + Direct Labor per unit + Variable Manufacturing Overhead per unit + Fixed Manufacturing Overhead per unit

Total Cost per unit = $5.70 + $3.20 + $1.60 + $3.70

Total Cost per unit = $14.20

Number of units produced = 11,000

Total Product Cost = Total Cost per unit * Number of units produced

Total Product Cost = $14.20 * 11,000

Total Product Cost = $156,200

Answer 2.

Period Cost = Selling Expenses + Administrative Expense

Variable Expenses:

Sales Commission = $1.10

Variable Administrative Expense = $0.55

Total Variable Expenses per unit = $1.65

Fixed Expenses:

Fixed Selling Expense = $2.70

Fixed Administrative Expense = $2.10

Total Fixed Expense per unit = $4.80

Total Period Cost for 11,000 Units = ($1.65 + $4.80) * 11,000

Total Period Cost for 11,000 Units = $70,950

Answer 3.

Variable Cost per unit = Direct Materials + Direct Labor + Variable Manufacturing Overhead + Sales Commission + Variable Administrative Expense

Variable Cost per unit = $5.70 + $3.20 + $1.60 + $1.10 + $0.55

Variable Cost per unit = $12.15

Answer 4.

Variable Cost per unit = Direct Materials + Direct Labor + Variable Manufacturing Overhead + Sales Commission + Variable Administrative Expense

Variable Cost per unit = $5.70 + $3.20 + $1.60 + $1.10 + $0.55

Variable Cost per unit = $12.15