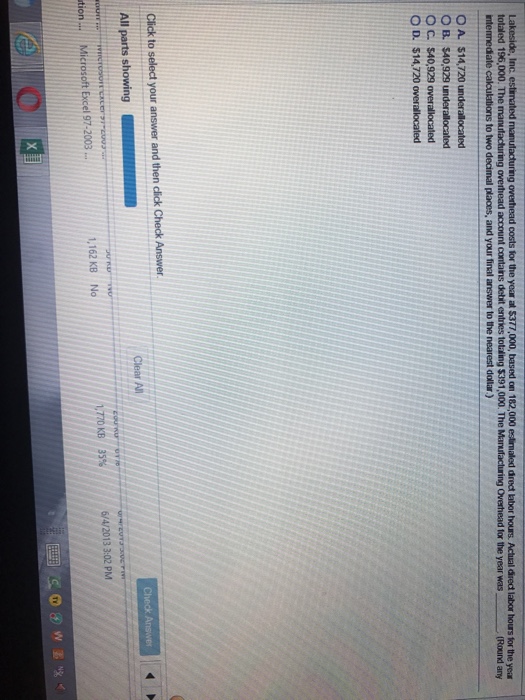

Lakeside, Inc. estimated manufacturing overhead costs for the year at $377,000, based on 182,000 estimated direct labor hours. Actual direct labor hours for the year totaled 196,000. The manufacturing overhead account contains debit entries totaling $391,000. The Manufacturing Overhead for the year was _______. (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) A. $14,720 underallocated B. $40,929 underallocated C. $40,929 overallocated D. $14,720 overallocaled