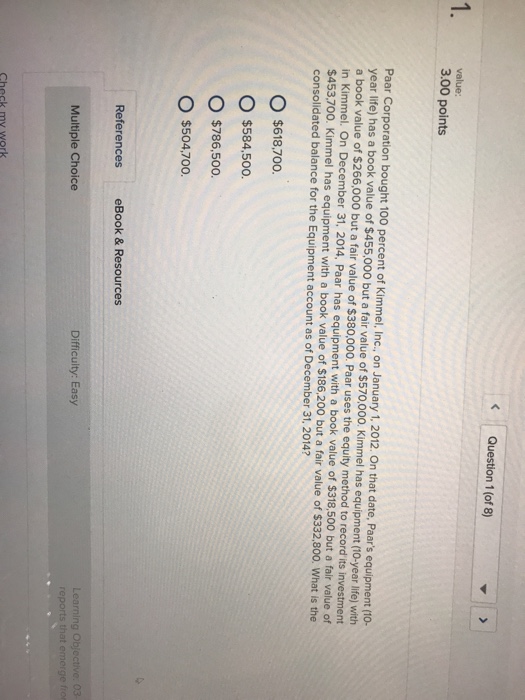

Paar Corporation bought 100 percent of Kimmel, Inc., on January 1, 2012. On that date, Paar’s equipment (10- year life) has a book value of $455,000 but a fair value of $570,000. Kimmel has equipment (10-year life) with a book value of $266,000 but a fair value of $380,000. Paar uses the equity method to record its investment in Kimmel. On December 31, 2014, Paar has equipment with a book value of $318, 500 but a fair value of $453, 700. Kimmel has equipment with a book value of $186, 200 but a fair value of $332, 800. What is the consolidated balance for the Equipment account as of December 31, 2014? $618, 700. $584, 500. $786, 500 $504, 700.